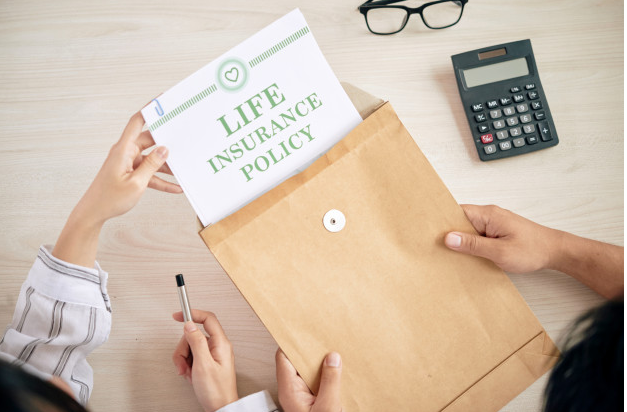

A life insurance policy pays tax-free money to your liked ones if you pass away during the regard of the plan. It can provide essential financial support to liked individually in excellent distress, as well as uncertainty.

But there are many false impressions regarding life insurance and it can be hard to understand how plans work. This article intends to separate the realities from the life insurance policy myths.

If you want to check different premiums of life insurance, please visit https://www.moneyexpert.com/life-insurance/.

A life insurance policy is costly

The expense of a life insurance policy will depend on numerous aspects, including your age and existing health and wellness. Policies cost less the more youthful you are when you take out the insurance, as well as obtain more expensive with age.

The rate additionally relies on regard to your policy, for instance, do you wish to be covered for 1-2 decades or the entire of your life? Also, the size of the pay-out you want your loved ones to get in case of your death.

Some advisers state you should look for a pay-out that is 6-10 times your annual wage.

So, if you earn ₤25,000 a year, you would define a “sum ensured” of ₤150,000 to ₤250,000.

The higher the collection payment, as well as the longer your cover, runs for, the more you will often tend to pay in insurance policy costs.

I do not require a life insurance policy if I’m young as well healthy

Indeed, you might not need life insurance if you are young, single, as well as have no dependants.

But if there are people who rely on your earnings, then a life plan deserves thinking about. Ought to a companion die sooner than anticipated, the last thing you will require is any type of monetary anxiety over how the mortgage or costs will be paid.

The more youthful you are, the less costly the life insurance policy will be.

If you want to cover a specified payment over an established variety of years, known as a “level term” life insurance policy, the month-to-month price will not raise throughout the regard to the plan.

So, if you obtain 25-year cover, with a payment of ₤150,000, then the costs will remain at a typical price of ₤10.54 a month for a person aged 18 to 29 throughout that time.

Bear in mind, that a life insurance policy just pays in case of your fatality. It doesn’t cover significant injury or illness.

If you wish to be covered for these, then important revenue or ailment protection insurance coverage deserves consideration. Both can be acquired as standalone cover, or included in a life insurance policy plan.

Life insurance via job suffices

You may be utilising some type of life insurance policy through an employer, which can likewise be called a “fatality in solution” benefit.

This would lead to a tax-free payment to a named beneficiary must you pass away while being a worker of the company, the fatality does not need to be work-related.

The pay-out is regularly almost 2-4 times your annual salary. It is a generous perk, but think of whether you might desire your household to get more than this.

Likewise keep in mind that you might not stay with that business throughout your career, as well as a new company might not provide a death-in-service benefit.

If so, you can end up having to think about life insurance at a later date, as well as the price would be more expensive as you grow older.

I will need annual wellness exams

This is a misconception, as well as is not a standard requirement of life insurance service providers.

A complete medical examination is likewise not normally needed when registering for a plan.

When you utilize, you will be asked about your way of life, as well as health and wellness, including your height, weight how much alcohol you consume, as well as whether you are a cigarette smoker.

You will additionally be asked if you have any kind of pre-existing health conditions, and concerning your family members’ case history. The bottom line is that if you are not straightforward in your application, you might be turned down for the cover or the payment can be lowered/refused outright.

A check-up is only required in particular situations. It can sometimes be needed if you are looking for a big quantity of cover or have pre-existing clinical problems.

Read also about avple

Details news here comicsonline

Related posts:

Forex & Crypto

Streamline Your Trades: The Latest in Forex Robot Tech

Categories

- Apps (1)

- Automotive (23)

- Beauty (7)

- Business (117)

- Celebrities (2)

- Digital Marketing (21)

- Ecommerce (1)

- Education (18)

- Entertainment (25)

- Events (6)

- Features (4)

- Fitness (10)

- Food (1)

- Forex & Crypto (16)

- General (105)

- Health (48)

- House (61)

- Lifestyle (48)

- Marketing (8)

- Parenting (3)

- Pets (10)

- Real Estate (7)

- Safety and Security (11)

- Social Media (20)

- Sports (97)

- Technology (67)

- Travel (22)